Credit Card Deals in Singapore pt.1: OCBC Card Promotion

For the last decades, we cannot imagine our lives without using credit cards. The simplicity of their use is beneficial. They save time, offer rewards and special deals and lots more. It’s not a big surprise that Singapore is among 3 cashless countries. Since 1989 the number of credit cards owned by Singaporeans rose by 95% and total billings made with credit cards by 96%! But with all the great stuff you get from using them, there comes some sort of confusion as well. Which card to use, how to apply for cards, what will I get, how rewards work and so on. We thought we should dig deeper into this question and decided to come up with a series of articles about Credit Cards.

In this article, we would like to talk about one of the most searched banks in Singapore - OCBC (Oversea-Chinese Banking Corporation Limited). Due to a variety of credit card types, you can easily find any kind of OCBC promotion for each of them. It doesn’t matter if you search for a specific one like OCBC Agoda offer or for a category like OCBC dining deal, or a special Zalora discount code OCBC - be sure you find it all! Why not have a more close look at the diversity of credit cards OCBC offers and what you can get.

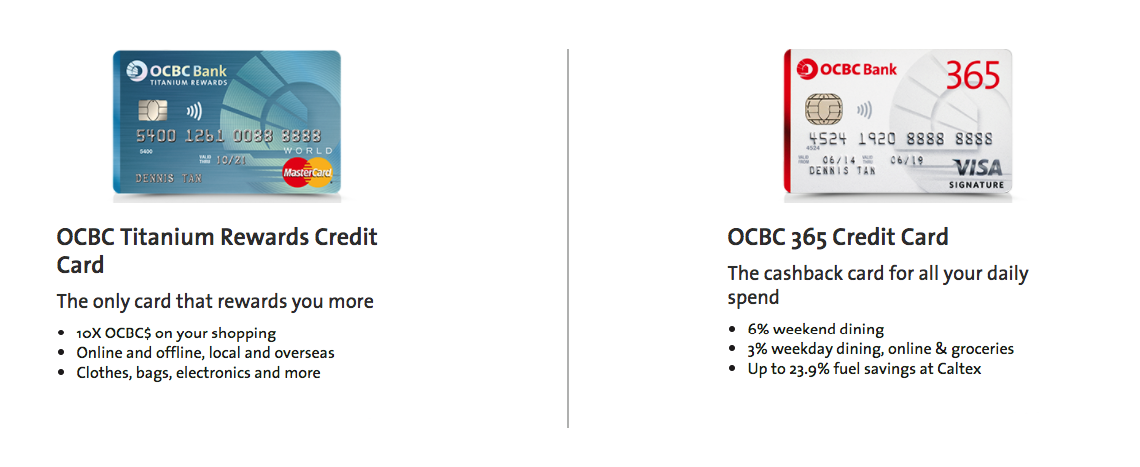

OCBC Titanium Rewards Credit Card and OCBC 365 Credit Card

Except for these obvious benefits you get:

- S$50 cash when your application is approved

- diverse cashback system for OCBC 365 card (link)

- extra saving on stores like Zalora, Apple or travel sites like Expedia

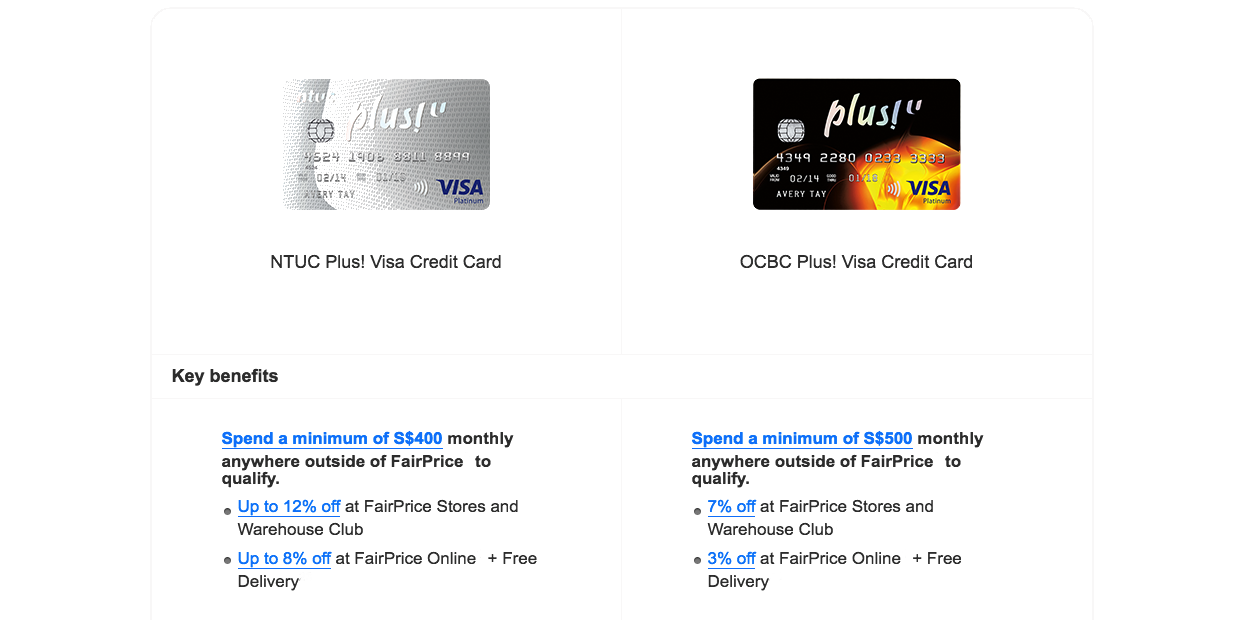

OCBC NTUC Plus! and OCBC Plus! Visa Credit Cards

Among other benefits are:

- special OCBC travel, shopping, dining benefits

- less spending on your fuel

- free children tickets to Bounce Singapore

- extra savings on FairPrice, Cheers, Popular and more

*enjoy Visa payWave option (a technology of contactless payments)

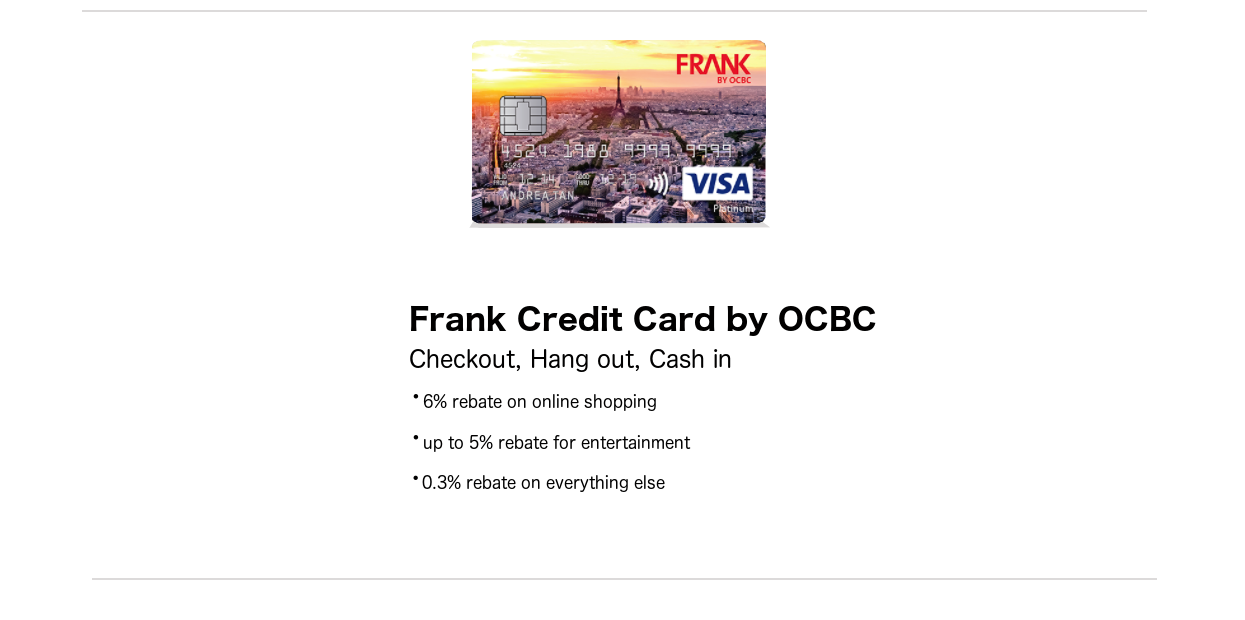

Frank Credit Card by OCBC

Moreover, you get:

- S$60 monthly rebates when you spend S$400

- 120 unique designs for your card

- ability to pay with mobile

- 3% entertainment rebate from Monday through Thursday and 5% entertainment rebate from Friday till Sunday

*enjoy Visa payWave option

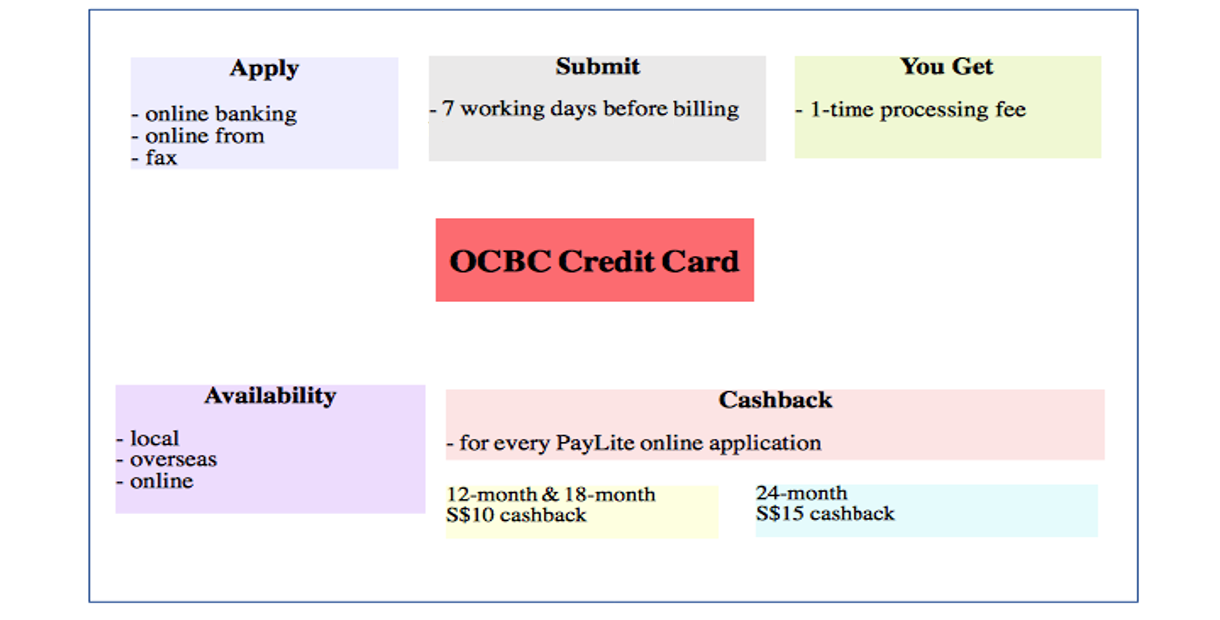

OCBC Cashflo Credit Card

Here are your other Cashflo OCBC credit card rewards:

- 3-month and 6-month instalment payments (for S$100+ and S$1,000+ purchase respectively)

- up to 50% savings on travel insurance

- discounts on Lotte World, A.H.C Cosmetic and The Cliff House Hotel

All-in-all, there are a couple of requirements that are the same, when you are performing OCBC credit card application:

- you must be 21 or older

- your annual income is over S$30,000

If put all the OCBC card promotion deals together, you can enjoy instalment plans (interest-free) with over 1,000 sellers.

Another really cool service from OCBC bank is PayLite. It is a system of interest-free monthly instalments. What you need to have to be eligible to apply is a credit card. Have a look at how it works.

Summing up, we can say OCBC credit card rewards are a really worthy thing. Not only you can pay easily, secure, fast, but also enjoy plenty of benefits. From what we read and investigated, we’d like to stand OCBC 365 Credit Card out of others for its wide range of cashback plans and card privileges & benefits.